If you want to follow along with new digital health developments and more of my writings:

Apologies for being a few days late with this post; it’s been a hectic couple of weeks. Since we’re talking about a publicly traded stock this week, a couple of quick disclosures upfront: I am not a financial advisor of any sort, and I am long LVGO.

For digital health to be successful as an emerging industry, companies in the space will have to succeed not only in raising private venture investment, but also in public markets. Over the past 5 years, digital health has repeatedly broken records when it comes to private funding, and in 2019, companies finally entered public markets in spades as well, with Livongo, Health Catalyst, Phreesia, and Change Healthcare all holding IPOs. All eyes are watching to see how they fare, as an indicator of what’s to come for the industry.

We’re going to focus on Livongo, which was founded in 2008 by Glen Tullman, former CEO of Allscripts. Livongo’s core product is for diabetes management, and it consists of two parts — a suite of smart, connected devices that collect data from the patient, and an algorithm of sorts to synthesize the data collected and recommend actions for patients to take to better manage their condition. The value proposition for the platform is that it enables both better clinical outcomes for the patient and reduced costs for the payer, thanks to fewer long-term complications.

Product

If you take a step back, the “mechanism of action” for Livongo’s product, if you will, is no different from standard diabetes management. Diabetes management has always been about monitoring blood glucose levels and modifying behavior (e.g. diets, exercise, medications) to keep sugar levels in check. Instead, Livongo’s innovation is in leveraging smart devices to collect data seamlessly in the patient’s home, and deliver actionable insights in real-time to the patient based on the data. This gives us a couple key benefits over standard diabetes management:

Data collection can happen more frequently, and with higher compliance, since it is part of an integrated suite that can build habits and trigger reminders

The feedback loop between data collection and actionable insights can be tighter, by automating part of the recommendation algorithm and delivering insights remotely

Actionable insights can be delivered more effectively, and with higher compliance, since it is part of an integrated suite similar to point 1

This underlying approach of a connected suite that collects data and provides recommendations has allowed Livongo to start expanding into adjacent applications, including weight management, hypertension, and behavioral health.

Beyond the advantages we’ve discussed, there are a couple of key questions that are critical to Livongo’s long-term potential:

How good is Livongo’s recommendation algorithm? How much of it is automated vs relying on clinician input (which will have an impact on the business’s cost structure and scalability)? How much of it is personalized to each patient vs fixed across the board (which will have an impact on protectability and IP potential)?

Livongo has cited strong compliance and patient uptake across the board with its platform, but how much of that is driven by organic patient need for the product vs proactive marketing, messaging, and oversight? Depending on how much hand-holding is required for adoption, this will have an important impact on the business’s cost structure and scalability as well.

Can Livongo’s platform drive the same value for other applications as it does for diabetes? Weight management and hypertension seem comparable, but behavioral health may prove to be significantly more challenging, due to the lack of clinically significant and easily measurable metrics to track.

Market Size

It goes without saying that diabetes is a massive and growing market. The US diabetes market alone was estimated to be worth $49 billion in 2019, with a CAGR of 9% over the next 5 years. The size of the market, particularly in the US but globally as well, is driven by two things: (1) the prevalence rate of the condition and (2) the cost of care for diabetic patients. In 2018, 34 million Americans had diabetes (10.5% of the population), and an additional 88 million had prediabetes. Each year, an estimated 1.5 million Americans are newly diagnosed with the condition. Because of the prescription medications required and the need for inpatient care in some cases, diabetes patients incur more than double the overall medical expenditures of the average patient, and ~57% of their annual expenditures are attributed to the condition ($9,601 out of $16,752 per year).

Since Livongo’s platform is designed for generic management of the condition, it can tap into the entire diabetes market immediately, instead of being restricted to a subset of the indication like new drug approvals. Furthermore, the platform acts as a supplement to existing medications, rather than a replacement, allowing it to target patients at any point in their care journey. According to Livongo’s website, the platform currently has 207k members, less than 1% of the total addressable market in the US alone. Looking solely at market size, it’s clear that there is plenty of room to grow.

Compliance + Outcomes

Since Livongo’s platform does not rely on a fundamentally novel mechanism per se, there is minimal risk on this front, and it should be unsurprising to expect positive outcomes as long as patient compliance is good. This touches on a broader theme in digital health — as care moves into the home and into the patient’s hands through digital technology, patient compliance and satisfaction becomes significantly more important to driving outcomes and patient adoption. From an investment standpoint, this particular point is important because poor compliance can be a red flag that remains hidden during pilots and case studies but becomes a significant drag on patient adoption at-market. It is clear that Livongo understands this, and has backed it up with hard numbers.

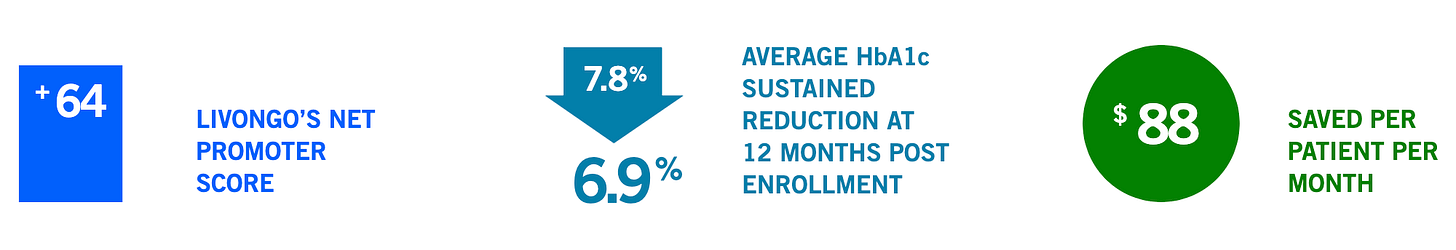

For a healthcare company with a B2B business model (which we’ll explain later), Livongo’s public facing brand is remarkably focused on the user experience. Livongo’s website frames their platform as a “member-first experience” and highlights several patient testimonials as well. They’ve supported this with a Net Promoter Score (NPS) of +64 and a 4.8/5 rating on the App Store.

Livongo has also conducted a number of case studies with health plans and systems to evaluate compliance and outcomes in a simulated setting. Two important metrics to look for here are the enrollment rate (% patients who enroll in Livongo) and activation rate (% of platform users who are active), which give a sense of real-world compliance. From their pilot with Jefferson Health, they report an enrollment rate of 49% and a very impressive activation rate of 90%. The one caveat here, as I mentioned earlier, is that it is difficult to determine how much patient marketing was needed to achieve these levels of adoption, and whether that is scalable at-market.

Given high patient compliance and satisfaction with the platform, it is unsurprising that Livongo’s clinical outcomes are strong across the board. On average, patients report a clinically significant reduction in mean HbA1c of ~0.9%, while saving payers $88 / patient / month. The cost savings are largely driven by the decrease in long-term complications (i.e., kidney failure, heart attacks, strokes) associated with a reduction in HbA1c level. Again, since the platform acts as a supplement to existing treatments and not a replacement, the comparison to diabetes management without the platform is appropriate.

Business Model

Livongo’s business model is a B2B approach that has become very common among digital health products, especially for chronic disease management. Instead of charging patients directly, Livongo partners with employers, health plans, and health systems to provide their platform as a benefit to members, charging a per patient per month fee for those using the platform. Market adoption with this strategy has been rapid to date, with 30% of Fortune 500 companies adopting the platform as of Q4 2019.

This approach positions the company extremely well for the long-term as well. The focus on managing chronic conditions enables a subscription-based revenue model which is probably far stickier than the average consumer tech subscription. The fact that the platform relies on relatively simple hardware allows for minimal variable costs, and as Livongo’s user base grows, they will be able to draw from a larger dataset of outcomes and cost savings, turbocharging adoption further. In other words, Livongo can leverage the favorable cost structure of being a software company, the stable revenue of being a SaaS company, and the virtuous cycle of outcomes data that comes with being a healthcare company.

Digital health represents a new age of healthcare and tech, with unconventional products and business models that blend the best of the two fields. Livongo is compelling for this reason — its platform uses connected devices and algorithms to augment outcomes from traditional diabetes management, and its business model combines the financial benefits of SaaS with the adoption curve of healthcare. Livongo has plenty of room to grow, and is a sign of what’s to come with public digital health companies.